House Bill 1405 could help data centers in Lawrenceburg and elsewhere in Indiana more profitable and affordable.

(Indianapolis, Ind.) - Data centers in Indiana are getting some encouragement from a bill which has passed the Indiana Senate.

Senators voted 46-0 to pass House Bill 1405 on Monday. The bill now heads to a conference committee so that differences in the House and Senate version can be hashed out.

If it becomes law, the equipment purchased by companies that seek data center services would be exempt from business personal property tax and the state’s sales tax. Additionally, electricity used by customers for qualified data centers’ equipment will be exempt from state sales tax.

“Not only does HB 1405 bring Indiana into consideration for companies looking for data center expansion but it also evens the playing field throughout all counties in our state by creating tiers of investment for smaller counties,” said Tom Dakich of Digital Crossroads, a mission critical data center complex currently under construction in Hammond, Indiana.

Digital Crossroads says it will be able to provide these state benefits and tax exemptions to its local, domestic and global customers.

Lawrenceburg Municipal Utilities constructed a data center last year as part of its new, fiber-optic telecommunications utility. According to LMU’s website, the utility serves the needs of residents and businesses in the city.

Supporters call HB 1405 one of the most aggressive tech and data center innovation economic development bills in the U.S.

Closure planned on State Road 1 in Dearborn County

Closure planned on State Road 1 in Dearborn County

First Lady Announces Near Completion of Fundraising Goal for Dolly Imagination Library

First Lady Announces Near Completion of Fundraising Goal for Dolly Imagination Library

Moms Club of Lawrenceburg to Raise Funds for YES Home

Moms Club of Lawrenceburg to Raise Funds for YES Home

Margaret Mary Health Celebrates Exciting Milestone on OB Unit

Margaret Mary Health Celebrates Exciting Milestone on OB Unit

Main Street Brookville Launches 2026 New Business Recruitment Initiative

Main Street Brookville Launches 2026 New Business Recruitment Initiative

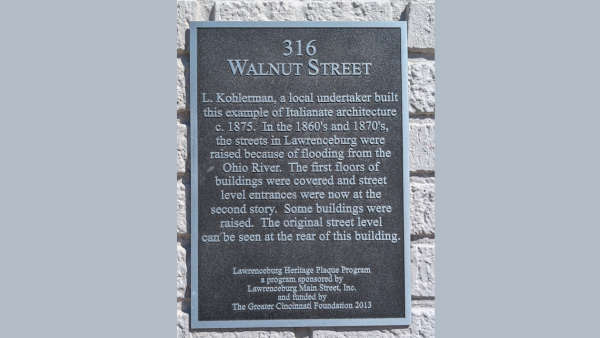

History Flows in Lawrenceburg

History Flows in Lawrenceburg