The merger will be made official on November 1.

(Lawrenceburg, Ind.) - Members of Dearborn County Federal Credit Union (DCFCU) in Lawrenceburg, IN, have voted to approve a merger with Bedford, IN-based Hoosier Hills Credit Union (HHCU).

The merger with HHCU will provide more than 2,000 DCFCU members in Dearborn and surrounding counties more expansive services including mobile and online banking, a wide variety of mortgage options, a comprehensive suite of commercial banking products and 8 additional service centers across southern Indiana.

“We are committed to maintaining the member-first, service-oriented legacy established by Dearborn County Federal Credit Union. Equally important is our commitment to foster financial wellbeing and accessibility in the region for decades to come,” said Travis Markley, President and CEO of HHCU.

“The 60-year history of the Dearborn County FCU reflects a consistently strong and healthy financial institution that has provided members the local lending, local decision-making and financial services they depend on,” said Katee Goodpaster, President and CEO of DCFCU.

Both credit unions have long been devoted to the well-being of their members and to community service. Goodpaster continued: “Our mission is a perfect fit with the strategic plan and history of HHCU. We are really looking forward to what the future holds.”

The Lawrenceburg Service Center will operate under the Hoosier Hills Credit Union name in the existing location and with the same management and staff. Markley will lead the combined credit union as President and CEO. Goodpaster will become the Vice President of Operations for the Hoosier Hills Credit Union Lawrenceburg Service Center.

What’s NOT changing:

- The DCFCU team’s outstanding service and their dedication to YOU

- Your Lawrenceburg Service Center and ATM location

- Your relationship with a solid, trustworthy financial partner

What you are gaining:

- 8 Additional service centers across southern Indiana

- Mobile banking and mobile check deposit capabilities

- Better rates on products and services • An ever-growing network of ATM locations

- Zelle® - a fast, safe, and easy way to send and receive money

- CardValet - an app supplying fraud protection through powerful card control and management

- HHCU credit card with no balance transfer fee, annual fee, or cash advance fee

- Wide variety of mortgage services, from conventional and jumbo loans to construction and land loans to home equity loans and lines of credit

- Secured and unsecured personal loans

- Comprehensive suite of commercial banking options

- Tax-advantaged options including Health Savings Accounts (HSAs)

- Cashier’s Checks, Money Orders and Gift Cards

- Ability to purchase debt protection, automotive mechanic repair coverage and GAP insurance

- 3-to-60-Month fixed-rate certificates

- Ability to purchase identity theft protection coverage

The Community Project Receives $1,000 Grant from DCF

The Community Project Receives $1,000 Grant from DCF

BCEF's Student Success Center Opens at Batesville High School

BCEF's Student Success Center Opens at Batesville High School

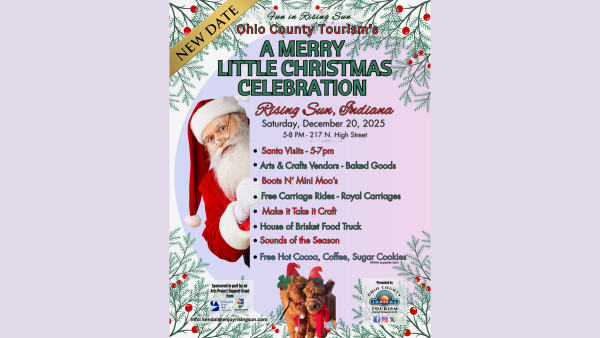

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Indiana Senate Rejects Redistricting Bill

Indiana Senate Rejects Redistricting Bill

OCCF Names Lilly Scholarship Recipient

OCCF Names Lilly Scholarship Recipient