House Bill 1002 would be the largest tax cut package in state history if signed into law.

INDIANAPOLIS - The legislative session is in full swing, and House Republicans are continuing to work diligently on bills addressing issues that matter most to Hoosiers. This year, we are focused on returning money to taxpayers, supporting nurses and boosting local public safety efforts.

Indiana is expecting to take in $3 billion more in tax revenue than anticipated, which would create a $5 billion surplus. In the last year alone, we've paid down over a $1 billion in debt. We've also made record investments in education, infrastructure and other critical programs. It's clear that our state's economy is running strong and now is the time to return money to hardworking Hoosiers and businesses through responsible tax cuts. That's why I joined House Republicans in passing House Bill 1002, which would be the largest tax cut package in state history if signed into law. The bill delivers direct relief to working Hoosiers by reducing Indiana’s individual income tax from 3.23% to 3%, lowering Hoosiers’ utility bills by repealing the Utility Receipts Tax, and encouraging new investments by lowering Indiana’s business personal property taxes.

With more than 4,000 nursing jobs currently open statewide, we must address the severe health care worker shortage. This session, I supported House Bill 1003 to provide flexibility to Indiana’s nurses seeking licensure, give nursing programs and nurse educators accommodations to help meet workforce needs, and help nursing students obtain the required hours to be licensed. I am thankful for all the work and efforts displayed by nurses in our local communities and across the state, and this bill would help meet our current and future needs.

To keep our communities safe, address jail overcrowding and help local officials redirect resources to where they matter most, a bill I authored would give judges discretion to sentence Level 6 felony offenders to the Indiana Department of Correction. State facilities often offer greater access to mental health and addiction treatment services than many local jails. Our goal is to get these Hoosiers access to resources that give them a better chance at recovering and staying out of our criminal justice system.

House Republicans recently advanced all of these bills, and they are now in the Indiana Senate for further consideration. As your state representative, it's important we stay connected. I'll continue providing updates on legislation as it moves through the process, and I encourage you to sign up to receive my e-newsletters by visiting www.in.gov/h67 and entering your email address. Reach out to me anytime at 317-234-9450 or h67@iga.in.gov.

Franklin Co. Residents Encouraged to Report Flooding Damage

Franklin Co. Residents Encouraged to Report Flooding Damage

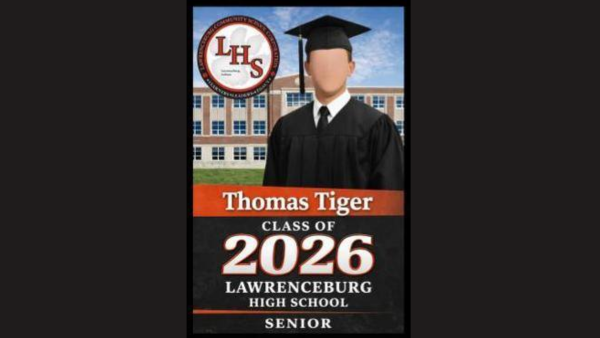

Lawrenceburg High School Announces New Tradition for Graduates

Lawrenceburg High School Announces New Tradition for Graduates

New Indiana Law: Penny-rounding for Retailers

New Indiana Law: Penny-rounding for Retailers

Jennings Co. Bridge Washes Away

Jennings Co. Bridge Washes Away

Local Schools Compete at 15th Annual Rube Goldberg Machine Contest

Local Schools Compete at 15th Annual Rube Goldberg Machine Contest