Dearborn County residents were surprised to learn how much more valuable their home is when assessment notices began arriving in the mail.

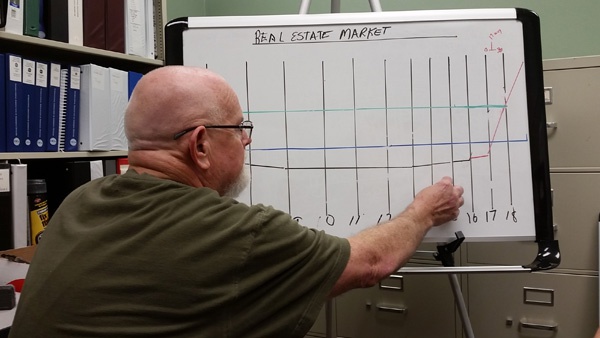

Dearborn County Assessor Gary Hensley points to a chart showing housing market sales trends on Thursday, August 30. Photo by Mike Perleberg, Eagle Country 99.3.

(Dearborn County, Ind.) – If you notice that your property assessment has increased dramatically this year, you aren’t alone.

When notices of assessment began arriving in mailboxes across Dearborn County on August 15, many residents did a double take on the new assessment dollar figure, the amount on which property taxes are figured from. In many cases, property assessments shot up by tens of thousands of dollars from just the previous year, even if a property owner didn’t improve an existing structure or added new structures.

Dearborn County Assessor Gary Hensley says you can thank the local real estate market for the higher assessments.

“The real estate market has seen a dramatic increase in valuation. It was primarily due to the increase in the market. It had nothing to do with whether you improved your house or not,” explains Hensley.

According to the Indiana Department of Local Government Finance, property values are part of the mass appraisal technique used to determine property values. The technique, also used in other states, looks at individual parcels in conjunction with other properties in their neighborhood. Assessors consider age, grade and condition of a home, usually judged from the outside.

Assessments are adjusted annually by comparing them to real property sales, or the actual selling prices of homes and property in an area. With each land transaction that takes place, the assessor’s office receives a sales disclosure form.

Hensley says that following the housing crash of 2008, real estate activity in Dearborn County had slowed with only slight increases in prices. Each year, Indiana county assessors must use a sample size large enough to give an accurate picture of the local market values. Dearborn County was having to use up to three years of market data to get the sample size needed.

Then in 2017, the local housing market got hot. So much so, Hensley explains, that the assessor’s office was able to rely solely on 2017 market data.

And not only did the pace pick up in 2017, but so did the prices. Homes which had sold dirt cheap during the 2008 crash are now being sold for vastly more money. According to the Indiana Association of Realtors, Dearborn County’s median selling price of a single-family home, townhome or condominium increased by 12.8 percent between 2014 and 2017, going from $140,000 up to $158,000.

The market has increased the neighborhood factors used in determining an assessment. Those neighborhood factors in populated areas such as Lawrenceburg, Aurora, Bright, and Hidden Valley have increased as much as 30 percent, Hensley says.

Hensley says while he cannot “chase” the selling price of a home, he is required as the county assessor to reflect the market. For that reason, some homeowners may continue to see their assessments increase annually.

While many property owners in Dearborn County are seeing higher assessments, others are noticing a decrease. Hensley says those are primarily owners of farmland and larger parcels. In February, the DLGF announced it is lowering the base rate for farmland from $1,960 in 2017 to $1,850 this year. It will go lower still to $1,610 in 2019.

Hensley dismisses any notion that any assessments have gone higher because the county needs more money from property tax revenues to maintain its budget.

“I don’t do that. We do what the market tells us,” he says, adding he is required to follow state laws.

A ratio study is submitted to the DLGF each year. Dearborn County’s 2018 ratio study was approved in February.

Property owners who disagree with their assessment do have the option to appeal it. An appeal must be made within 45 days of the assessments. Because Dearborn County’s assessment notices are dated August 15, owners there have until September 28 to appeal.

They can also visit the assessor’s office at the Dearborn County Government Center in Lawrenceburg for an in-person review.

“Primarily what we’re going to tell you is that nothing has changed on the card except the neighborhood factor. And that factor increased as much as 30 percent based on the sales that were taking place in the area,” says Hensley, who will be leaving office the end of 2018.

SDCSC Superintendent Gives Insight into Possible Manchester Elementary Closure

SDCSC Superintendent Gives Insight into Possible Manchester Elementary Closure

VIDEO: Dearborn Co's Four Living WWII Veterans Gather for George Klopp Sr's Birthday

VIDEO: Dearborn Co's Four Living WWII Veterans Gather for George Klopp Sr's Birthday

Water Boil Advisory Issued for Holton Community Water Customers

Water Boil Advisory Issued for Holton Community Water Customers

One Killed in Rollover Accident in Franklin Co.

One Killed in Rollover Accident in Franklin Co.

Madison, Vevay Among Best Small Towns in the Midwest

Madison, Vevay Among Best Small Towns in the Midwest

Sunman Elementary Principal Has Interim Label Removed

Sunman Elementary Principal Has Interim Label Removed