The bill provides tax relief to Hoosiers businesses.

Shutterstock photo.

INDIANAPOLIS – The first bill to be passed into law this legislative session was signed by Governor Eric Holcomb on Wednesday.

The governor signed Senate Bill 2, which provides tax relief to Hoosier businesses.

Authored by State Sen. Scott Baldwin (R-Noblesville), the legislation changes state tax law so that LLCs and S Corps can deduct all state tax payments on federal tax returns, on behalf of owners, resulting in what could be over $100 million in federal tax savings for Hoosier small businesses over the next two tax year filings.

Under federal law, businesses can deduct their state tax payments from their federal tax liability. For businesses that pay income tax as a corporation, such as C corporations or larger businesses, this deduction is unlimited.

For small businesses where the owners or shareholders pay their own individual income taxes, their deduction is limited to $10,000.

The new law will allow LLCs and S Corps to receive an unlimited federal deduction for their state tax payments.

"I am really appreciative of the effort that went into passing this piece of bipartisan legislation," Baldwin said. "Seeing the commitment to moving this forward in a timely manner reinforces the legislature's and state's commitment to helping Hoosier small businesses. This new law builds on our already strong business climate and continues to make Indiana a great place to live and work."

Eligible businesses can take advantage of this new law on 2022 taxes being filed this year.

The Community Project Receives $1,000 Grant from DCF

The Community Project Receives $1,000 Grant from DCF

BCEF's Student Success Center Opens at Batesville High School

BCEF's Student Success Center Opens at Batesville High School

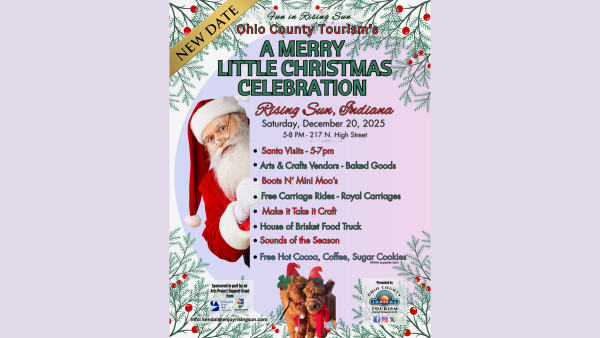

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

OCCF Names Lilly Scholarship Recipient

OCCF Names Lilly Scholarship Recipient