Clerk-Treasurer Richard Richardson believes the city should begin borrowing money in order to keep some funds liquid for day-to-day operations.

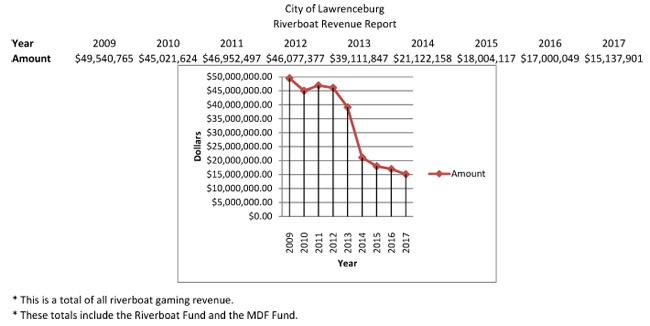

Data source: Lawrenceburg Clerk-Treasurer's Office

(Lawrenceburg, Ind.) - The City of Lawrenceburg’s clerk-treasurer is giving citizens an idea of just how far riverboat casino revenues to the city have fallen.

It isn’t a pretty picture.

Democratic Clerk-Treasurer Richard Richardson says total riverboat revenue to the city’s Riverboat Fund and MDF Fund has fallen from $49.5 million in 2009 to just $15.1 million last year. That’s a 69 percent decrease in less than a decade.

The sharpest decline was from $39.1 million in 2013 to $21 million in 2014. That’s when casino gaming was introduced in Ohio and siphoned a number of gamblers who frequented Hollywood Casino Lawrenceburg.

“We are a city that budgets yearly based on a source of income that is unreliable and clearly decreasing,” Richardson says.

HOW MUCH MONEY HAS LAWRENCEBURG'S LOCAL CASINO MADE IN THE FIRST HALF OF 2018? FIND OUT HERE.

Richardson says the city needs to continue to be fiscally responsible, which he believes would be the cash-flush city borrowing money for some current projects.

The clerk-treasurer appointed in February argues that the city should bond $6 million to help pay for construction of the new Lawrenceburg Civic Park at High and Short streets – ground has already been broken. The city has also advanced a project for a new splash park at Pat O’Neill Memorial Pool, with common council voting to spend up to $1.1 million.

He says borrowing would help the city maintain some liquidity in order to continue providing support for philanthropic purposes and maintaining city parks and facilities. It would also help the city to establish a credit rating.

“If the city were to lose revenue sources for any reason, the day to day functionality of the city would decrease and we would be forced to bond to run day to day operations in the city or cut funds and services currently provided.”

Richardson says his office publishes monthly financial reports on the city website, lawrenceburg.in.gov.

Read Richard Richardson's full letter below:

The Importance of Fiscal Responsibility

Today, I wanted to take time to educate you and the citizens in regard to the need for continued fiscal responsibility within the City. The total of all Riverboat Gaming dollars continues to drop year after year. Between 2009 and 2017 we’ve seen a total drop of $34,402,863.65. That is a 69% decrease in funds over 9 years. From 2009 to 2017 we’ve seen a 28% drop in funds. We are a City that budgets yearly based on a source of income that is unreliable and clearly decreasing. By far, the sharpest decline was seen between 2013 and 2014. During that time, various racino’s and casino’s opened in Ohio creating a competitive advantage for the state of Ohio. Today, there are various other projects, such as a continued growth in horse track gaming and sports betting, that could potentially cause the City of Lawrenceburg to notice additional sharp declines over the coming years. This may not be an immediate concern, but someone should be taking notice of these trends and acting upon them.

The importance of establishing a bond rating, or credit rating, is important to the future of the City. Our current revenue stream allows the City to have the option of a lower interest rate of 3.5%-5% (on the high end) for the bonding of any project. If the City were to lose revenue sources for any reason, the day to day functionality of the City would decrease and we would be forced to bond to run day to day operations in the City or cut funds and services currently provided. The Municipal Development Fund (MDF) relies heavily on an annual True-Up and ground lease payment. The ground lease payment has remained steady at $5,940,000, but our agreement with the LCD has changed from a $500,000 commitment annually to a $1.6 million dollar commitment beginning in 2017 and a 1% increase in subsequent years. The True-Up has seen a drastic decline over the past 9 years. For instance, in 2009 our True up was $29.4 million dollars verses our 2017 True Up, which came in at $2.9 million dollars. Our Riverboat fund relies heavily on Wagering, Admissions, and Supplemental Admissions income. In 2009 wagering was $20.8 million dollars verses our 2017 number of $8.4 million dollars. Looking at that fund alone you see a drop of $12.4 million dollars between 2009 and 2017. I’m sharing this, not to cause panic, but to give Council an understanding of the significance of these drops.

We are a City that has used its funds for many philanthropic purposes. Thus far, as of 8/31/18, we’ve been able to provide revenue sharing in the amount of over $11.4 million dollars. This includes funding various organizations in and around the City. These are noble causes and worthwhile causes, and this is all the more reason to make sure we keep as much liquidity in our accounts as we can. We want to continue providing for these organizations and taking care of the various parks, playgrounds, and City facilities that are already within our scope of protection. Although it is true that we are a fortunate City with extreme wealth, it is important to note that we are a City that offers its citizens and employee’s benefits that other areas of the country could only dream of. Those benefits are not free of charge and they cost the City to have and maintain.

As always the Clerk-Treasurer’s office has an open door policy and we publish our monthly financial reports and claims that Council approves along with other information. This can all be found on our portion of the web site www.lawrenceburg.in.gov. I ask concerned citizens to check out this information; we are an open book.

Today, we have before us an option to bond the Civic Park for $6,000,000. This would assist in keeping liquidity in our money market accounts as well getting us the much-needed bond rating.

CIVIC PARK $6,000,000 BOND OPTIONS

This provides us with assistance in two areas:

1. This will assist in creating better liquidity in our money market accounts by retaining current investments and drawing interest in them. Taking into account current trends it is foreseeable that yields could climb into the upper 4% mark.

2. This will assist in creating a bond rating for the City of Lawrenceburg to assist in securing our City’s future making sure we have a rating when the time comes for it to be utilized.

20 Year option:

|

Payment Begin Date |

Principle Amount |

Interest Expense |

Total |

|

July 1, 2019 |

$6,000,000 |

$3,541,083 |

$9,541,083 |

*Payment total would be approximately: $477,000 per year at a 5% interest. Interest projections are on the high end and could, potentially, be lower.

25 Year Option:

|

Payment Begin Date |

Principle Amount |

Interest Expense |

Total |

|

July 1, 2019 |

$6,000,000 |

$4,585,000 |

$10,375,375 |

*Payment total would be approximately: $415,015 per year at 5% interest. Interest projections are on the high end and could, potentially, be lower.

*Payments would come from TIF dollars and overage would be paid from the MDF fund. We would ask the Redevelopment Committee to pledge their TIF dollars to this payment.

Richard Richardson

Clerk-Treasurer; City of Lawrenceburg

RELATED STORIES:

Judge: Lawrenceburg Must Honor Agreement Giving Franklin Co. $500K In Casino Cash

L'burg Council Sets Splash Park Budget At $1.1M

New Lawrenceburg Civic Park Could Lure More Downtown Investment

2018 First Half Casino Revenues: Flooding Hurt Rising Star And Belterra, But Hollywood Benefited

Tie-Breaking Vote Makes Richardson Lawrenceburg's New Clerk-Treasurer

The Community Project Receives $1,000 Grant from DCF

The Community Project Receives $1,000 Grant from DCF

BCEF's Student Success Center Opens at Batesville High School

BCEF's Student Success Center Opens at Batesville High School

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Indiana Senate Rejects Redistricting Bill

Indiana Senate Rejects Redistricting Bill

OCCF Names Lilly Scholarship Recipient

OCCF Names Lilly Scholarship Recipient