The tax credit available to Indiana educators could be boosted from $100 up to $500.

Indiana State Senator Jeff Raatz. Photo by AJ Waltz.

(Indianapolis, Ind.) - A local lawmaker’s bill would expand the tax credit Indiana teachers can receive for buying classroom supplies.

The legislation is one of a number of bills this legislative session aimed at addressing Indiana’s teacher shortage, mainly by trying to fatten or alleviate their pocketbooks.

Republican State Senator Jeff Raatz’s Senate Bill 362 would increase the income tax for classroom supplies from $100 up to $500 per year. It would be granted to teachers, principals, librarians, counselors, psychologists and superintendents.

“Out of the goodness of their hearts, our teachers are spending their own money to make sure Hoosier students have the supplies they need during the school year,” said Raatz, who is the chairman of the Senate Education Committee.

“If passed, this bill would help ensure the teachers in our state receive the reimbursement they deserve.”

According to Raatz (R-Richmond), nearly 41,000 Indiana teachers claimed the tax credit in 2016. Of those who claimed it, 90 percent took the maximum $100 credit.

SB 362 passed the Senate unanimously on Monday. It now heads to the House.

If made into law, it would take effect immediately and allow the exemption to apply to purchases made since January 1, 2019.

The Community Project Receives $1,000 Grant from DCF

The Community Project Receives $1,000 Grant from DCF

BCEF's Student Success Center Opens at Batesville High School

BCEF's Student Success Center Opens at Batesville High School

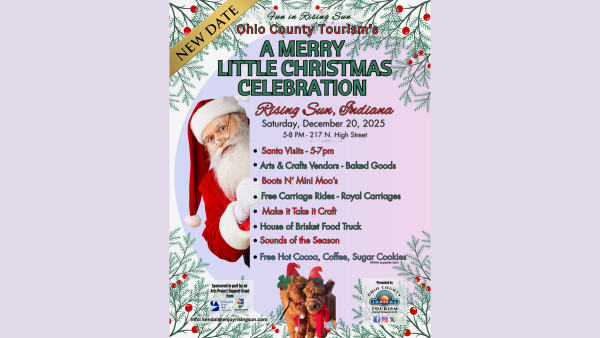

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Ohio Co. Tourism Reschedules Merry Little Christmas Celebration

Indiana Senate Rejects Redistricting Bill

Indiana Senate Rejects Redistricting Bill

OCCF Names Lilly Scholarship Recipient

OCCF Names Lilly Scholarship Recipient