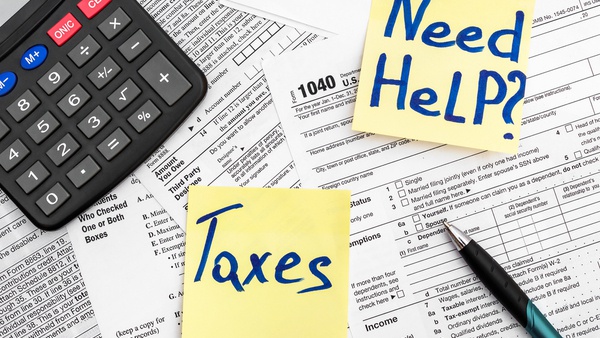

Low to moderate income taxpayers may be eligible.

Shutterstock photo

CINCINNATI - The United Way of Greater Cincinnati is offering free tax preparation and filing help for eligible citizens.

How Does It Work?

Visit one of United Way's tax sites to have an IRS certified tax volunteer prepare and file your return for free or file on your own.

There is no penalty to file taxes to claim these credits and they do not affect any benefits you are already receiving.

Who is Eligible?

Low-to-moderate-income taxpayers may be eligible for the free tax preparation and filing service, including those with disabilities and limited English-language abilities.

The 2025 Tax Season began on January 20 and runs through April 15.

For more information, visit uwgc.org/freetaxprep.

Napoleon State Bank Announces Retirement of Former President, Board Member

Napoleon State Bank Announces Retirement of Former President, Board Member

Indy Woman Identified as Victim of Fatal Crash on State Road 56

Indy Woman Identified as Victim of Fatal Crash on State Road 56

New Patient Care Manager Named at Our Hospice of Jennings County

New Patient Care Manager Named at Our Hospice of Jennings County

Arrest Made in Green Township Road Rage Incident

Arrest Made in Green Township Road Rage Incident

Ripley Co. Highway Dept. Urges Motorists to Watch Out for Mowing Crews

Ripley Co. Highway Dept. Urges Motorists to Watch Out for Mowing Crews

Middle School Student Found with Pocket Knife Facing Disciplinary Action

Middle School Student Found with Pocket Knife Facing Disciplinary Action